Multi-acquirer payment platforms are incredible until fraud becomes a formidable challenge. Building and maintaining a custom platform-level fraud management system can be costly. Yes, you may need a 7+ figure custom solution. In what we’ve built for clients, we’ve found a better path. Start with lean interventions to optimize your fraud management ROI and set yourself up for success as you build a custom solution.

Feeling like the fraud outweighs the benefits?

By taking customer’s payment information and routing it to one of multiple processors, multi-acquirer systems provide significant benefits: access to additional payment methods, improved acceptance rates, cost savings, and near-zero downtime. However, the increasing complexity of fraud management can undermine these advantages.

Navigating fraud in your platform can feel like a blindfolded tightrope walk. On one hand, customer expectations for seamless, one-click/touch payments are rising, and the business is eager to facilitate quick transactions. On the other hand, accepting payments without thorough scrutiny poses significant risks, as payment hackers continually devise sophisticated methods. In 2022, the US alone witnessed $8.8 billion in fraud losses, while the global total reached $41 billion.

The lean pathway to winning against fraud

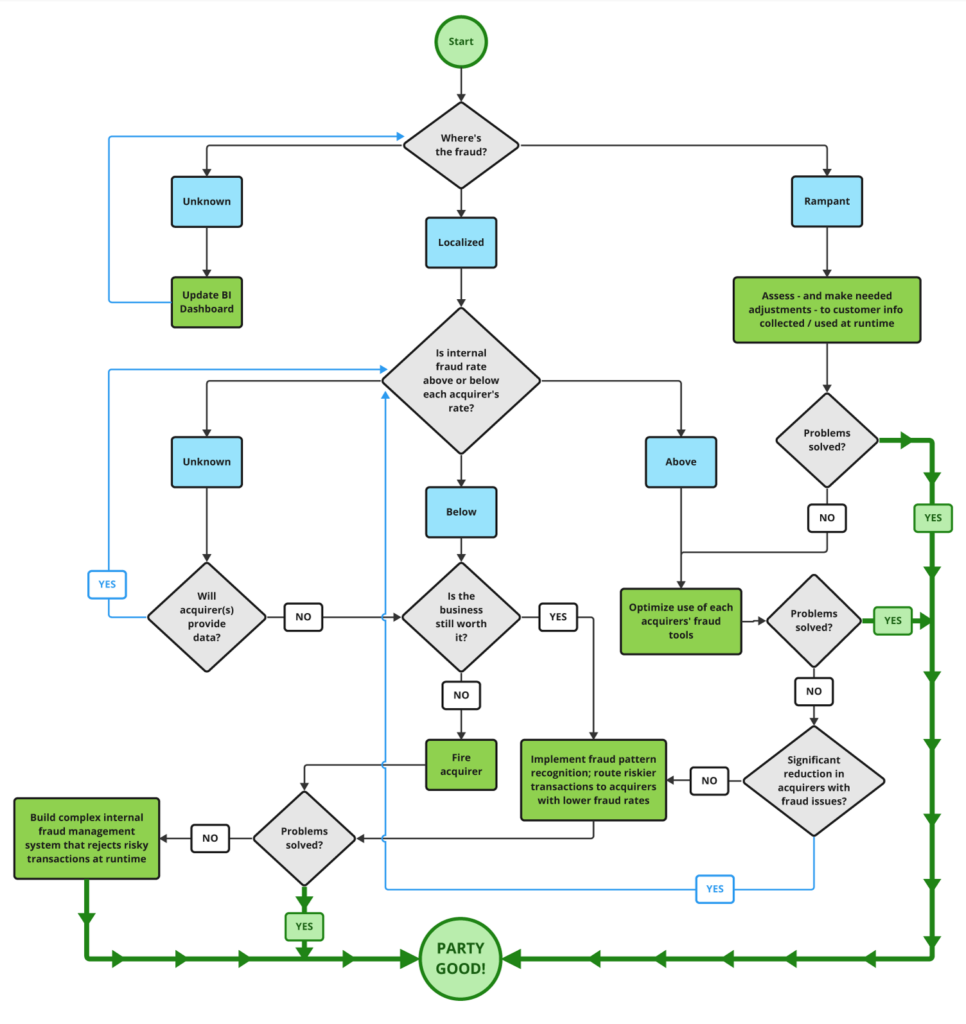

This decision tree illustrates the complex fraud management headache you’re facing. Even so logically organized, there are numerous questions to go through to be able to identify root causes and effective solutions. Most must be researched and solved for each acquirer individually. This might make investing in a custom fraud management system seem tempting.

However, following the lean interventions in the diagram will optimize your ROI by reducing the cost of building a custom system and delivering better fraud reduction results.

Follow each of the lean steps below, learn from the results, and make data-driven decisions for the next stage.

1. Enable data-driven fraud management decisions

Your team needs to be able to quickly address all fraud-related questions and compare them across your transactions. Ideally, this is via a Business Intelligence (BI) dashboard that allows them to slice and dice by key transaction details: acquirer, customer location, transaction amount, payment type, card brand, and more. With an intuitive UX, your team can quickly investigate fraud patterns by sorting and filtering platform data.

Identify the best lean experiments by collecting questions your team can’t currently quickly answer. It might be specific PSPs’ fraud rates, geographical slicing, payment method analysis, or transaction amounts. Prioritize these questions and, one or two at a time, configure your dashboard to answer them. Revisit with the team every few months – the questions and their priorities will change as your context and dashboard evolve.

2. Collect the right fraud prevention data at runtime

To balance the tightrope mentioned at the beginning of the article, checkouts must gather minimal information while also ensuring sufficient data for fraud detection. Prioritize and customize which data your checkout collects – e.g., email, name, or billing address – based on context, considering factors like customer IP/geography and deviations from typical patterns for specific customers or merchants.

Use your dashboard data to identify which context clues most correlate with fraud in your current payments data. Implement logic to optimize runtime data collection for those contexts. Make small adjustments, assess results, and determine the next most valuable changes.

3. Experiment with acquirers’ fraud prevention tools

Each acquirer in your ecosystem likely offers its own fraud prevention tools, often with customizable settings. Finding the right balance is crucial: too lax increases fraud losses, while overly strict blocks valid transactions, reducing revenue. Acquirers can provide insights on configuring fraud tools based on your context and use cases. Work with your team to apply these insights, along with data from your BI dashboard, to configure each acquirers’ settings.

Lean out this process by making configuration changes in experimental groups – know your data from your BI dashboard before you start, make a few changes, measure the impact, use that result to inform the next configuration changes.

4. Is fraud enough to get a divorce?

Not all acquirers are equally effective at fraud prevention. While the business likely had great reasons for adding an acquirer, it’s wise to reevaluate based on their fraud performance. Could the business do better focusing on acquirers with better fraud results? IT and business leaders can analyze fraud data and demand improvements from low-performing acquirers, or even remove them.

With an optimized BI dashboard, you can even model the financial impacts of removing an acquirer. Conduct experiments by significantly reducing transactions to low-performing acquirers and explore which changes optimize for lower fraud and higher profits. This data from these experiments will enable you to optimize acquirer-routing logic based on fraud, or even help you decide to fire an acquirer.

5. Lean pattern recognition, the foundation for a custom system

Your acquirers’ fraud tools and custom platform-based fraud management systems share a common engine: sophisticated fraud pattern recognition algorithms. Building and maintaining these systems involves teams of data scientists, financial/payments experts, and numerous developers within multiple product teams.

A leaner approach is available. Using data from the lean interventions discussed above, identify patterns causing your worst fraud issues. Collaborate with a small team to implement and optimize specific algorithms. For example, if geography affects fraud rates among different acquirers, develop logic to track their performance by region and integrate a content specific fraud-prevention score into your transaction routing logic. Or perhaps issues aren’t acquirer-specific but involve patterns like product types, times of day, or payment methods. You can implement logic to gather extra customer information where fraud is most prevalent.

This approach lets you build your custom system incrementally, targeting your worst fraud migraines. Instead of investing millions and months or years building an all-encompassing system for all your fraud headaches, you make smaller, strategic investments where most needed. You can then decide your next steps based on real-world results.

Want a thought partner on your lean journey?

If you are looking to optimize your fraud management ROI and accelerate fraud prevention, Integral is here for you. Our software consultants have built these systems for clients, and can help you leverage lean experiments, enable data-driven decisions, and enhance your platform’s fraud prevention tools.

Get in touch with us at https://integral.io/contact/ or at hello@integral.io.

It’s time to build your great idea.