It’s 2024. Online sales are essential for every business. Customers can buy anything online. At the same time, digital payments options have become overwhelming. Customers expect to pay instantaneously, easily, and with airtight security. And there’s no sign digital payments’ evolution will slow down.

Boiling it down to three options:

How do you start with digital payments? Simplify by considering three options:

#1 Become your own payment gateway: an unlikely start

This approach suits global brands like Walmart or Apple, offering control and cost savings. However, with its complex technical, compliance, and regulatory requirements, it’s only feasible if you’re handling billions in online transactions. Start with options 2 or 3 – those can lead to option 1 when scale merits.

#2 Simple Payment-as-a-Service (PaaS) integration: a lean entry point

Ideal for most businesses, including giants like Google, BMW, or Amazon, integrating a leading PSP (Payment Service Provider: e.g. Stripe, PayPal, Square, etc.) into your commerce site is a strong start.

Here’s why:

- Speed-to-Value: with only a line or two of code, your customers can pay you in an array of convenient, efficient, and secure ways. You and your team focus on making and selling your product, not payments software.

- High-Quality CX: leading PSPs provide a slick UX and easy-to-integrate-with APIs with nearly zero downtime; for a reasonable per transaction cost you give your team and your customers industry leading payments experience

- High Reliability: leading PSPs have a strong interest in every single transaction being a real payment from a real customer to a real merchant, it’s how they get paid. As such, their SRE and fraud protection are strong value-adds to your online sales.

With simple PaaS, you more quickly start doing business online with real customers. You can validate your online offerings and iterate on refinements before bigger investments in payments machinery.

#3 Payments-Platform-as-a-Service (PPaaS): valuable options, lower costs

At some point, as your online payments revenue, regional footprint, and complexity increase, a single PSP can become an inconvenient constraint. This is one indicator it’s time to consider PPaaS.

By building a custom payments platform, you’ll gain:

- Fine-grained control: increase conversion and decrease transaction costs by choosing which PSP and payment options you offer based on what works best for each of your products, global regions, target personas, etc.

- Seamless customer journey: earn customer trust with a coherent payments experience across online commerce; PPaaS enables a seamless branded payments UX and a unified customer wallet and transaction history, wherever they are in the world, whatever page they land on, and whatever PSP you choose.

- Unified business view: spot profitable opportunities, problematic patterns, and cost-saving potential via dashboards with transaction details and system activity / performance from all online activity, PSPs, payment methods, products, global regions, and more.

If these benefits sound like what your business needs, read on.

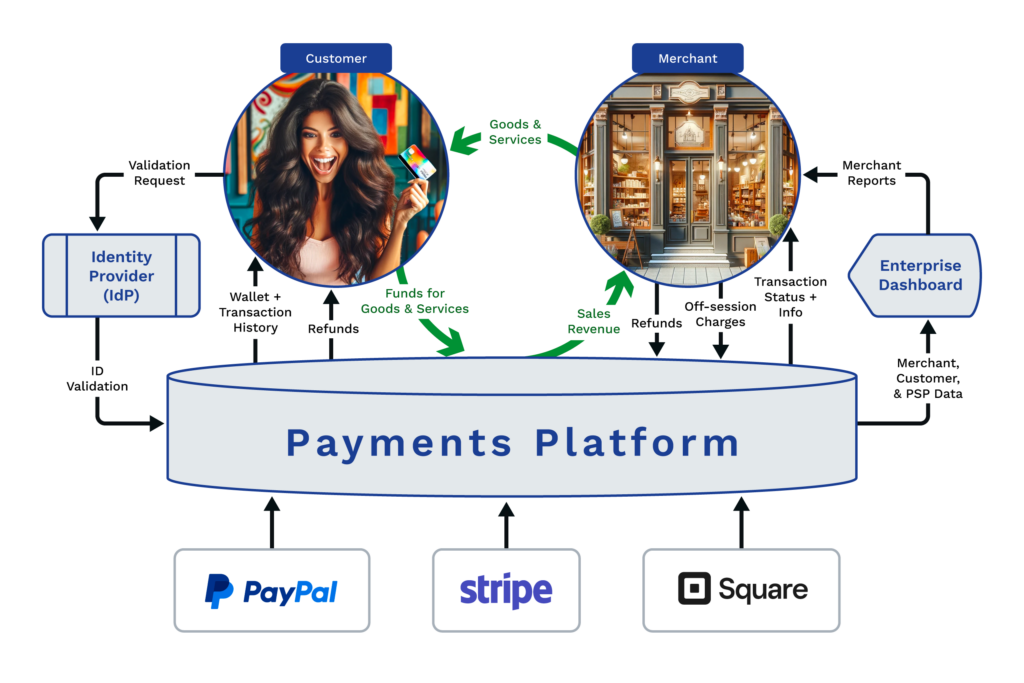

What’s a PPaaS?

A PPaaS system is a set of orchestrated components (the platform) that facilitate payments. The platform’s core goal is to enable a customer to quickly, easily, and securely pay a merchant, and receive goods and services. In the digital world, this becomes incredibly complex; the platform helps manage this complexity, while enabling additional functions, data insights, and efficiency for customers and merchants.

Your system will have:

- Micro-frontend components: checkout, wallet, and transaction history are most common.

- Back-end APIs that handles security, payments, refunds, transaction status updates, and wallet updates.

- Business logic about which PSPs to use when and where and custom handling (e.g, taxes, fees, discounts) for various products, payment methods, & transaction types.

- A transaction and customer database that stores de-identified information the platform uses often.

- A dashboard system that makes it easy to see and analyze platform data.

- IdP (Identity Provider) integration to verify each customer’s identity and control access to their wallet & transaction history.

Implementing PPaaS: A Step-by-Step Guide

- Map out PPaaS vision and business value:

Create simple visuals that become living system maps, constantly referenced and updated as you build out your payments platform. The diagram above, slightly more detailed and made specific to your context, is a good place to start.

These visuals need to communicate:

- The valuable outcomes that the platform delivers

- The customer journey(s) your platform supports

- The role of each technical system, front-end and back-end

- Build one simple flow at a time:

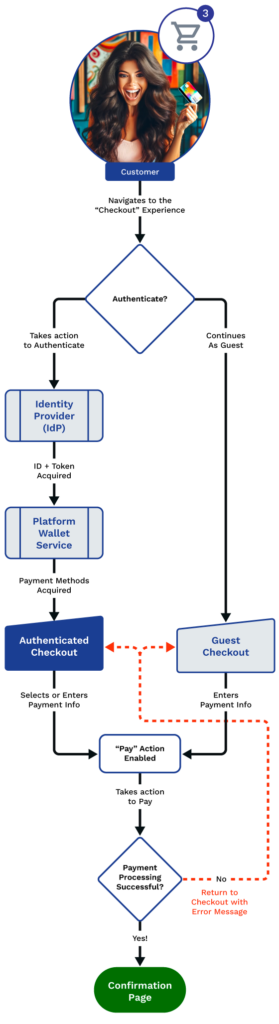

You’ve got the big picture map. However, building from this quickly becomes confusing and overwhelming. Create clarity and focus by turning one pathway at a time into working customer-ready software. Prioritize the flow that generates the most value for you. Checkout is a likely first flow. Getting detailed on your priorities also matters here – for example, consider if you need a one-time sale or a recurring/subscription checkout as your first flow – which better serves you?

Choose priority based on building an entire customer flow, not a feature or feature set – this focuses priority on the next valuable payments action(s) you’ll enable.

Conceptualizing PPaaS flows can be difficult: both payments themselves and managing a platform add layers of complexity. Make this easier with architectural flow diagrams like the one here. This more detailed view shows how the parts of the platform serve a particular flow – helping your team and stakeholders have a clear, aligned view of what you’re building and the value it provides.

The key here is a lean iterative process. Decide your highest priority flow, diagram it, build it, refine your diagram(s) to represent what you built. Decide the next highest priority flow and repeat the process. This enables you to build up your platform one highly valuable flow at a time, while keeping diagrams that map the overall platform and the flows it serves.

- Maximize reusability:

Use your big picture map from step 1 to keep the team aware of long-term platform goals. Encourage them to consider how components for each flow will be re-used throughout all flows. This impacts everything from overall microservice architecture to how you approach individual field, file, and folder naming and organization throughout your repo.

Openly discuss what you’re learning about reusability every iteration – encourage the team to be candid and rumble about learnings and risks/issues. Fix reusability mistakes early – the costs can escalate exponentially later on.

Well-built platforms are efficient, cost-effective and powerful. Poorly built ones become confusing, unmaintainable nightmares.

- Use your own software, playing the role of integrator and customer:

One of the challenges with PPaaS is that your microservices are going to be plugged in on another customer-facing site. Even if you build a single page application checkout, it will sit within a larger commerce flow. Because you have to wait for integration with an overall customer flow you don’t own, it can be difficult to demo PPaaS.

In order to dogfood PPaaS services, we create a mock site for demoing every use case the platform serves. This site provides a simple UI for inputting parameters used to load each microservice. This mock site allows you to demo the PPaaS customer experience, and also show integrators how they’re expected to load PPaaS components for each use case.

- Use momentum from early customer usage to build the rest of the platform:

Building up PPaaS systems can be overwhelming and development can easily stagnate. Drive momentum by prioritizing integrators who are ready to go live. White glove your first one or two, and any integrators with significant volume. Serving integrators this way creates focus for dev teams. It accelerates gathering learnings and creates a culture of ongoing platform refinement, refactoring, and extension. It’s also the fastest way to get from demoing platform services on your mock site to showing them live in customer usage.

Production usage excites and accelerates PPaaS adoption.

Ready to launch your digital payments journey?

Want to optimize your ROI on digital payments investments? We’d love to talk more about how the lean mindsets and steps above apply to your context. Let’s get you more quickly making money from real customers, and minimize the pain and waste in your digital payments technology.

Shoot me an email (paul.mack@integral.io) or sign up for a Integral Product Success Lab – our free Labs are a 1-2 hour session where we’ll facilitate and nerd out with you on your payments challenges and opportunities. We’d love to work with you to mobilize lean practices to give jet fuel to your digital payments systems.