We live in an age where many purchases are done online and transactions have to be fast and flexible and they must happen without losing the trust of your customers. While the well-established automotive sales industry is bringing their systems into the present and future, it becomes even more important to introduce updated payments in a way that’s efficient, secure, and as seamless as possible. It may be tempting to roll your own solution, especially when your organization will have specific custom needs and integration but that bears costs of re-inventing the user experience, maintaining a custom solution, and becoming expert in security, compliance, and fraud prevention, among other things.

Thankfully, there are payment service providers (PSPs) who have already solved many of the problems you would have to face and can make it easy to roll out a solution with greater speed and confidence than if you created something from scratch. Some

leading companies that come to mind are BlueSnap, Stripe, Finix and Square. For this discussion, we’ll zoom in on Stripe’s offerings, although many of the features we’ll explore are available across the board.

Understand your client’s needs and define the customer experience

Every client presents a unique set of challenges and requirements, shaped by their organizational structure, customer demographics, and the urgency with which they need to market their products or services. These variables are critical in developing a tailored payment solution that not only aligns with their operational framework but also resonates with their target audience.

For instance, a client might seek a highly customizable payment gateway that flawlessly integrates with their current e-commerce infrastructure, enabling personalized promotions and discounts. Such features are pivotal in boosting customer engagement and driving sales. However, to truly refine the customer’s payment experience, a deep understanding of the preferred payment methods is essential.

In today’s digital economy, customers expect a variety of payment options at their fingertips. Assessing whether your client’s audience prefers traditional payment methods like credit and debit cards, or modern alternatives such as digital wallets, is paramount. This analysis should inform the implementation strategy, ensuring that the payment process is as seamless as possible, reducing friction and enhancing convenience. Customization could also involve implementing features such as one-click payments or subscription-based billing options. The objective is to cater to the diverse preferences of the target demographic, ensuring that the payment gateway is not just a tool for transaction but a bridge that enhances the overall customer experience. Stripe has been an easy choice for us since it covers all of these bases well in addition to providing a high level of customization options via their API.

Unique to automotive sales, your client may require a payment solution that supports complex financing options, including lease agreements, installment plans, and trade-in valuations. Additionally, integrating with dealership management systems to streamline the purchasing process and provide real-time inventory updates could be crucial in delivering a superior customer experience in this industry.

In a scenario where it’s important to get features into the hands of customers quickly while keeping an eye to a fully custom implementation, it’s incredibly helpful to have several levels of implementation options available from the PSP. As an example, starting with PSP-hosted product and checkout pages may be a great way to quickly add value and enable transactions with the goal of gathering data about customer sentiment that can be used later while customizing the experience and purchase flow. The larger the integration, the more valuable it may be to have this flexibility.

Build and fine-tune

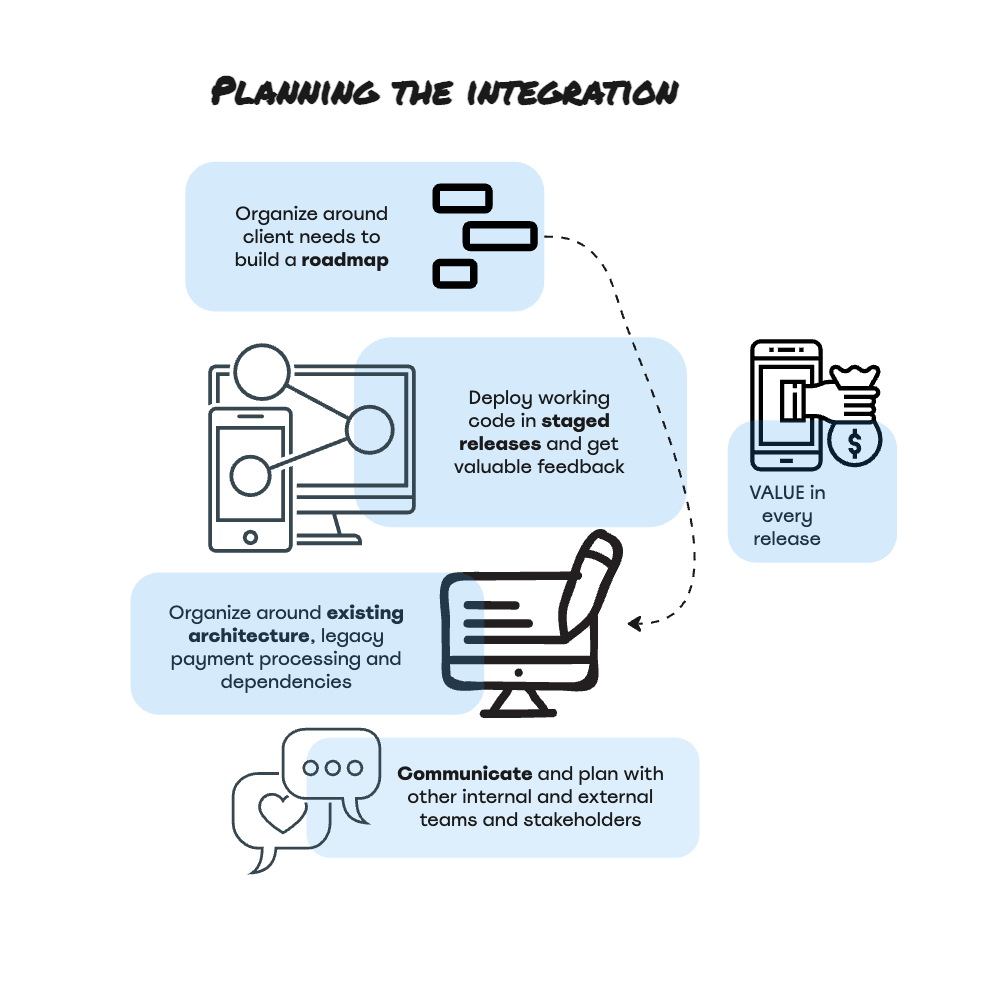

Re-imagining an enterprise client’s payment processing can be a long and messy process, but it doesn’t have to be. One way to mitigate the mess and forge a path to successful development and a happy client is by releasing early and often, validating assumptions, and iterating in this pattern as you go. Using continuous integration delivery and deployment methodologies will not only allow you to show something to the client and build confidence, but it can also surface any customer pains that might have previously been missed.

When starting off with designing a checkout flow, you may be able to get fast wins with a PSP-hosted solution. This will allow you to start accepting payments from customers quickly. The downside is that the hosted solutions are often very static by not allowing customizations for branding. While your customers are making purchases, you can fine-tune the checkout flow into something more custom for your business. When we implement with Stripe, we have access to their wide array of APIs which we can use to deliver a customized checkout experience complete with branding.

Of course, fine-tuning and recognizing things like customer fall-out and pain points is an ongoing process that requires reporting on user activity, sales, cart activity, and details around fraud and chargebacks. Most PSPs will offer reporting in some form and, like the solution overall, you can build something from the ground up, but it’s best to make use of existing reports early on to get moving rapidly. You’ll soon discover what’s valuable and what’s missing. That’s where it becomes important to know what reporting depth and customizations your PSP makes available to you. In our case, Stripe’s pre-built reports cover the most commonly needed information, but a client had some very specific needs. We took a staged approach, first customizing existing reports with Stripe’s platform reporting tools and later built out highly tailored reports, specific to the unique requirements of this enterprise client thanks to Stripe’s reports API flexibility.

Whichever PSP you choose, be sure you first know all of the reporting and customization capabilities available to you and consider them carefully with regards to your client’s specific needs and the likelihood that those needs may become more complex and less out-of-the-box.

How we won turned our client into an advocate

Early on, we made a concerted effort to identify our client’s needs, infrastructure, and possible complications we might run into before we wrote a line of code. Armed with this information and a product development strategy around efficient, maintainable code and a staged, feedback-centric roll-out, we were able to deliver value to the client and their customers quickly. We had a plan that involved constant feedback from our client partners which consisted of other parts of the enterprise whose customers would be using what we built. Through each stage, we looked closely at what we’d built, what was working, what wasn’t, feedback, and learnings from reporting and used all of that to adjust our roadmap and processes to deliver the most valuable product and results for the client. As a result of all of this, we not only kept our client happy, but they became an advocate for us.

Bringing it all together

As we’ve seen, there’s many options for PSPs and none are individually guaranteed to be the right solution for every client and their needs. The most important thing you can do for yourself and your clients is to take the time to understand their needs, both immediate and long term, and the capabilities of the PSPs you have to choose from. Choose the right PSP and put together a strategic roadmap that will be reviewed and adjusted regularly based on feedback and reporting. Keep your client engaged in the conversation and deliver value quickly with continuous integration and delivery, turning your client into an advocate.

We gave examples of how a Stripe enterprise integration went with one client. At Integral, we have Stripe certified architects and developers who have worked on integrations with clients of different sizes and needs and we’d love to continue the discussion further if your team could benefit from our experience in building solutions that integrate Stripe or other PSPs.