As digital commerce becomes the norm in vehicle sales, payment becomes a surprisingly pivotal part of the customer journey – 59% of customers have abandoned a shopping cart when their preferred payment method wasn’t available.1 This is a transformational and business-endangering shift from the buyer journey auto companies have known for decades.

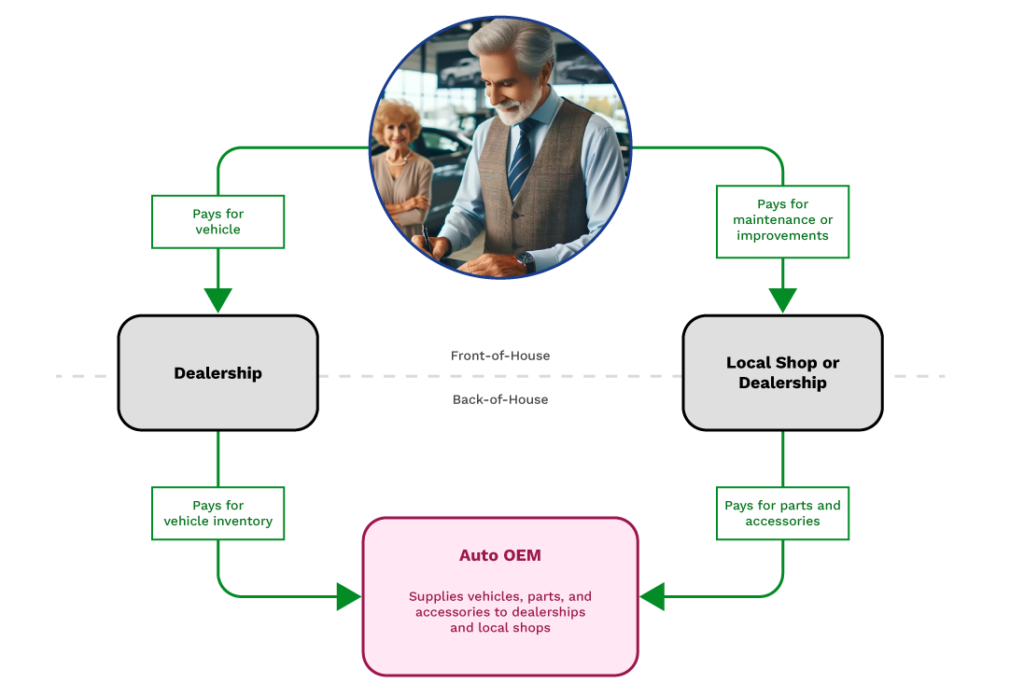

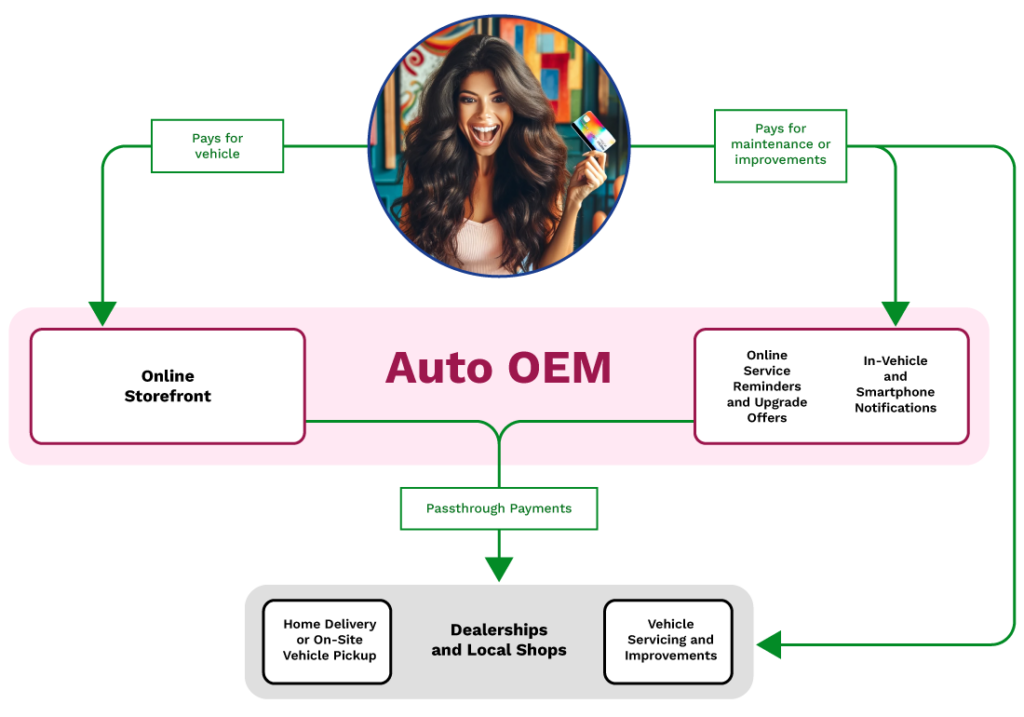

Read on to understand the shift that’s happening, shown in the two diagrams below, and discover four key insights for auto IT leaders seeking a winning path to turn payments into a market differentiator.

How the digital revolution is changing auto

It wasn’t that long ago that vehicle buyers didn’t expect much more than the basic ability to pay with simple methods – checks, bank transfer, and credit cards. Because so much of the process was in person, a vehicle buyer invested significant effort to get to writing the final check – with risk along the way that they became disinterested, found a better deal, or decided they weren’t ready to buy. When they did let a dealer know they were ready to buy a specific vehicle, payment was a final formality, a less likely point for a customer to walk away from the purchase.

Auto OEMs built up nearly a century of technology, supply chain systems, and customer relationship management to support this legacy model. Dealers, local shops, and other businesses played “front-of-house” roles managing the customer experience, while Auto OEMs focused on manufacturing vehicles and parts. Payments technology, policies, and people at each company in the auto supply chain have a deep legacy tailored for this role.

As digital commerce becomes the norm in vehicle buying, auto OEMs must shift from “behind-the-scenes” manufacturer to “front-and-center” one-stop shop for customers’ needs. Vehicle buyers now expect a seamless customer journey where they can

- pay via whatever method is most convenient for them

- have that payment method securely saved, alongside their preferences and order history

- receive a customized payment experience in all future purchases that makes ownership easy

This is a massive shift in what’s expected of auto OEMs’ digital payment systems – and that impact bleeds out to dealers and suppliers, sometimes in surprising ways. It also provides opportunities to make exponential leaps in the customer experience, and the value captured by auto companies. Modern digital commerce experiences and payment systems can increase conversion at each step of the customer journey and increase overall customer lifetime value.

Payments as a winning superpower

In the legacy customer journey, dealers and local shops managed the customer experience, while auto OEMs kept them supplied with high quality vehicles and parts. In the new world, customers are looking to auto OEMs to provide a seamless digital customer experience, while dealers and local shops play a supportive role at the needed point.

And the digital commerce flow is different – customers might configure multiple different vehicles, multiple different times. When they finally are ready to buy, they expect fast, easy, secure payment with their preferred method of payment. If the auto OEM doesn’t offer the payment experience they want, over half of those customers are likely to abandon their cart.

And there’s increased surface area where auto OEMs are now taking digital payments. Instead of an ongoing stream of payments from dealers and local shops, digital auto OEMs now manage digital transactions with millions of customers, in vastly different global markets. Many of these transactions require managing complex business rules around the auto OEMs cut and what’s passed through to dealers and local shops. And digital payments are not just for vehicle buying; they now also include direct sales of parts and in-vehicle services.

While these changes may seem overwhelming, four key focal points will drive auto leaders to digital payments wins. As you lead your payments systems transformation, stay ahead of your competition and market disruptors by:

1) Prioritize customer journey over technical details and domain expertise

One common mistake in digital commerce transformation is companies seeking to become experts in all the new technical and regulatory domains, including payments. While the technical and regulatory details matter deeply, the differentiating driver in digital commerce is the centrality of each customer and how the customer journey is managed.

Winning auto companies will focus on creating innovative digital experiences that win with customers – and payments systems that serve that customer journey.

As auto OEMs step from “back-of-house” manufacturer to a “front-of-house” role, the first step is creating experiences customers love and the business finds profitable. Defining the new customer relationship strategy and user journey is the transformational change auto OEMs need to own. The exact technology used and achieving regulatory compliance is an essential, and secondary priority – dependent on first defining what digital experiences and flows payments tech is serving.

2) An orchestrated payment platform lowers the cost of keeping up with digital payments

For many auto companies, becoming an expert in global payments tech and regulation is a distraction from the core business of building and selling vehicles and all the things related to them that customers love. You won’t be able to keep up if you need to custom-build integrations and UX for every new payment tech. Fortunately, many companies specialize in payments expertise. Buying features from these domain experts drastically reduces the cost and time for auto companies to stay on the leading edge. At the same time, it’s highly risky and unsustainable to become vendor-bound, hence the pressure to instead custom-build in-house.

How do auto companies address this catch-22? Build a customer-facing platform you can easily plug each service provider into, with branded microfrontend components served by a set of shared, orchestrated APIs. This allows leveraging of service providers’ expertise, while giving auto companies the ability to plug-and-play service providers in and out as needed. This also gives you a home for complex payments business logic you’ll need.

Check out “Got PPaaS? A starter pack for digital payments” for more on building up your payments platform and “Leveraging PaaS and PPaaS to future-proof digital payments” to explore how payments platforms lower your cost of change and keep you ahead of market disruptors.

3) Integrate with existing enterprise systems to make payments a digital accelerator

Another advantage of an orchestrated payments platform is the opportunity to keep payments seamlessly integrated with your existing enterprise architecture. Unfortunately, as upgrades to payment systems are made one-at-a-time and difficult to keep integrated with existing systems, the switch to digital commerce can often instead fragment internal payments data availability and disjoint the customer experience.

It doesn’t have to be this way, though. With intentional management of a centralized payments platform, individual upgrades can be managed within the platform, while the platform maintains consistent customer experience and data flow to internal systems. Because the payments platform provides a unified surface area for all customers’ payment interactions, it can:

- leverage your current customer identity system so customers’ payment details are associated with all their other customer data

- integrate with existing enterprise dashboards and/or create new ones, making customer payment trends easily available for marketing, in-vehicle services, and other business units

- provide a centralized transaction database and tokenized wallet that gives customers seamless access to their payment methods and transaction data across all interactions.

4) Lead all parts of your enterprise to world-class customer payments experience

Some of your internal lines of business may already have processes and technology that can deliver modern customer payments expectations. Likely though, many of them have big shifts to make to move from the legacy model to the modern direct-to-customer-facing world. Be ready to show them what their front- and back end systems need to deliver and teach them how to set up their business processes to match. A few simple steps can ease the cost and pain of this:

- Build sandbox integrations of your payment platform components to model how you expect them to be used; these models also enable you to demo your components and are helpful in testing and debugging

- Maintain simple, developer-friendly integration guides; model off guides that developers rate highly and are likely to be familiar with at your organization (e.g., existing cloud service providers, leading payment service providers)

- Create centralized, open support forums (e.g., via a Slack channel and/or GitHub discussions); these won’t completely replace your ticketing systems, however they will accelerate your integrators’ by allowing crowdsourced support (from your team and from integrators helping each other), and by providing a searchable history of common issues/questions and their solutions/answers.

Want expert thought partnering and delivery help as you lead this transformation?

We’d love to talk more about your digital payments product strategy and how you can keep ahead of high-tech disruptors in auto digital commerce. We can help you make leaner, higher ROI decisions about how to best architect your payments systems and more effectively achieve speed-to-value.

Shoot me an email (paul.mack@integral.io) or sign up for an Integral Product Success Lab – our free Labs are a 1-2 hour session where we’ll facilitate and nerd-out with you on your payments systems.